Comfort Systems USA Announces First Quarter Results

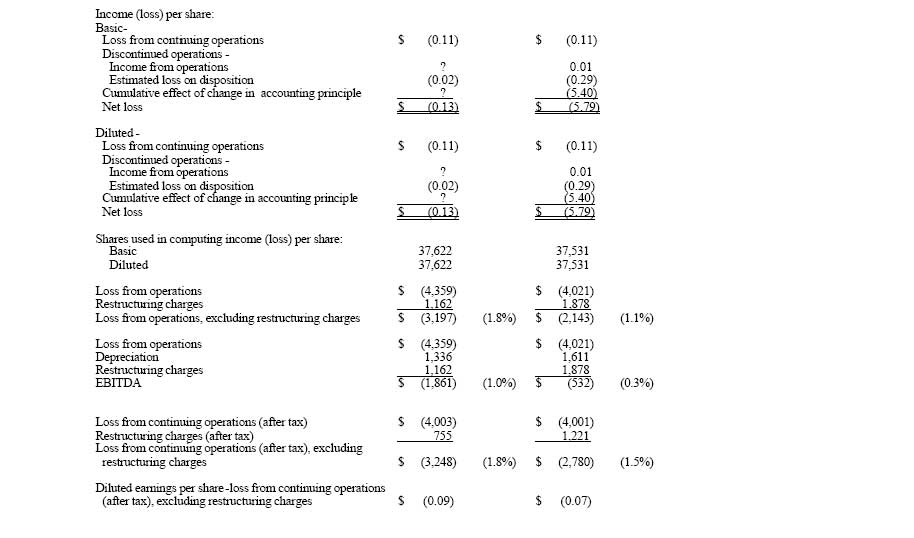

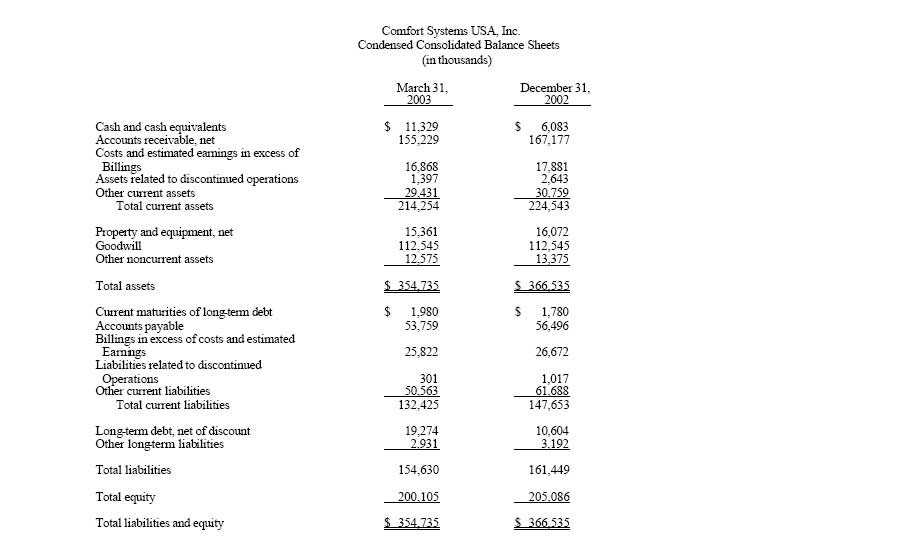

Houston, TX – May 5, 2003 – Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial/industrial heating, ventilation and air conditioning (“HVAC”) services, today announced a net loss of $4,816,000 or $0.13 per diluted share, for the quarter ended March 31, 2003, as compared to a net loss of $217,254,000 or $5.79 per diluted share, in the first quarter of 2002. These amounts include results of discontinued operations. The 2002 results include two significant charges for unusual items – one relating to the adoption of a new accounting standard for reporting of goodwill and other intangible assets, and another relating to the Company's sale of certain operations, principally 19 units sold to Emcor Group, Inc. in March 2002. Excluding these items, net loss from continuing operations for the quarter was $4,003,000 or $0.11 per diluted share in the first quarter of 2003 as compared to a loss of $4,001,000 or $0.11 per diluted share in the first quarter of 2002. The Company reported revenues from continuing operations of $182,414,000 in the current quarter as compared to $189,626,000 in 2002.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, “As we've previously noted, our industry experienced further slowdown through the first quarter amid renewed uncertainty over the economy and international events. We also had cost overruns on certain projects in two of our operations. With these developments occurring in what is already our traditionally slowest seasonal quarter during the year, we reported a net loss from continuing operations in the first quarter.”

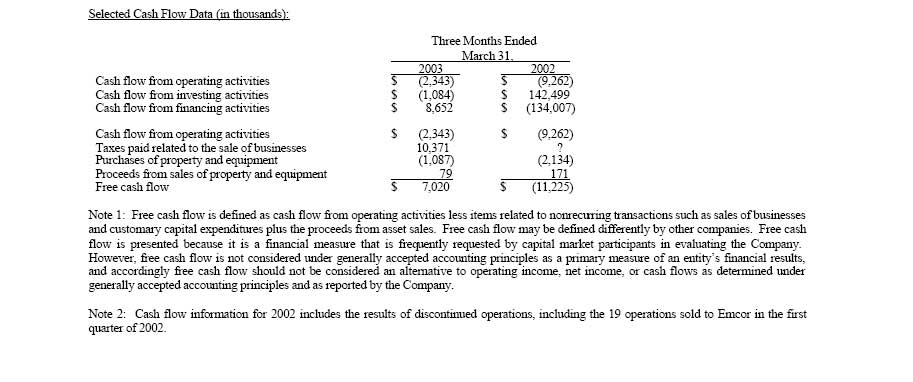

Murdy continued, “While our first quarter results were disappointing, we are already seeing indications that activity levels in our industry will improve over the course of this year. Our backlog at the end of the first quarter was up 6% compared to both the beginning of the quarter as well as the comparable period in the prior year. In addition, we have launched significant new cost reduction efforts. Based on these developments along with continued strong emphasis on operational execution, we expect to be profitable in the second quarter, to produce positive free cash flow for the year as a whole, and to post improved operating results for 2003 as compared to 2002. With a strong balance sheet and a proven ability to generate profits and positive cash flow in very challenging industry conditions, we believe we are well positioned to produce increased net income, especially as economic conditions improve.”

The Company will host a conference call to discuss its financial results and position in more depth on Tuesday, May 6, 2003 at 9:00 a.m. Central Time. The call-in number for this conference call is 1-773-756- 4705. A replay of the entire call will be available until 9:00 a.m. Central Time, Tuesday, May 13, 2003 by calling 1-402-220-4182.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 84 locations in 57 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, the lack of a combined operating history and the difficulty of integrating formerly separate businesses, retention of key management, national and regional declines in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission.