Comfort Systems USA Announces First Quarter Results

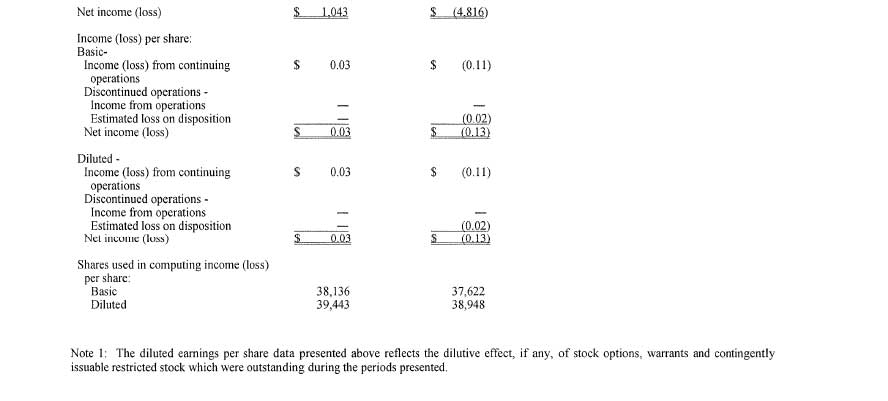

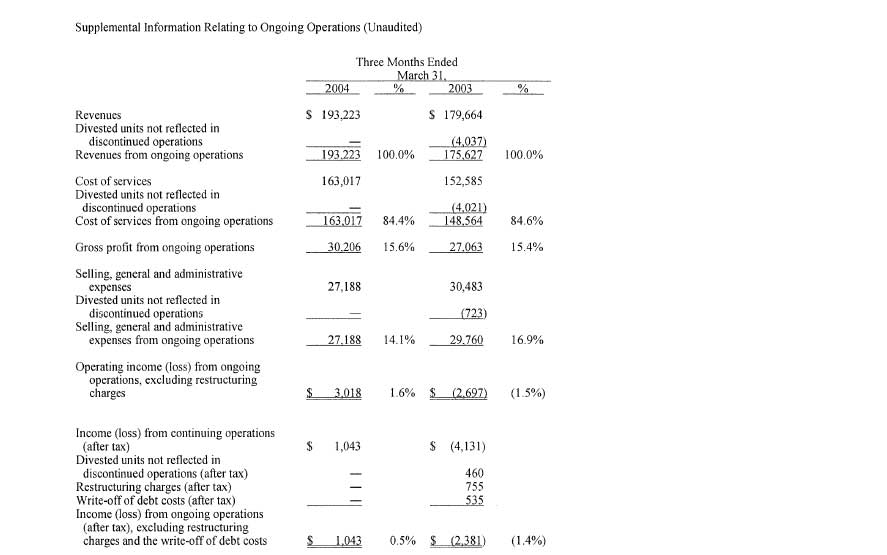

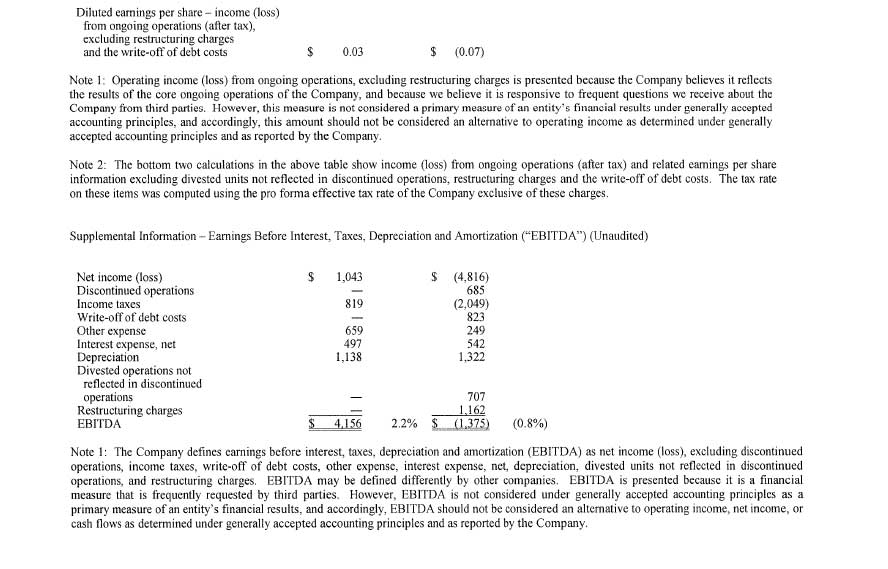

Houston, TX - May 3, 2004 - Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning ("HVAC") services, today announced net income of $1,043,000 or $0.03 per diluted share, for the quarter ended March 31, 2004, as compared to a net loss of $4,816,000 or $0.13 per diluted share, and a net loss from continuing operations of $4,131,000 or $0.11 per diluted share, in the first quarter of 2003. Excluding restructuring charges, the write-off of debt costs, and the effect of divested units not included in discontinued operations, the net loss from ongoing operations in the first quarter of 2003 was $2,381,000 or $0.07 per diluted share.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, "We are pleased to report noticeably improved results for our first quarter, typically the period of our lowest seasonal activity levels of the year. We posted year-over-year gains at every major line of the income statement, as challenging industry conditions eased some, and as our productivity and execution efforts began to show results. Consistent with improving activity levels in our markets, and effective business development at our operations, our backlog increased 17% from yearend to a record $473 million."

The Company reported revenues from continuing operations of $193,223,000 in the current quarter as compared to $179,664,000 in 2003. Excluding the effect of units divested in 2003 not included in discontinued operations, revenues at ongoing operations were $175,627,000 in the first quarter of 2003. The Company also reported negative cash flow of $5,921,000 following very strong fourth quarter cash flow, as the Company supported renewed revenue growth. This cash flow was funded almost entirely from existing cash balances as the Company maintained its level of debt at an all-time low.

Murdy continued, "Even with our strong revenue and backlog performance, our primary emphasis for 2004 remains on productivity, execution and margin performance. As with many other industries, we have seen turbulent pricing and supply developments in the markets for certain commodities, including steel, iron, and copper. Given that most of our costs are labor-related, and based on certain steps we have taken to address these market developments, including earlier commodity buying and protective contract provisions, we experienced no appreciable impact from these developments in the first quarter and, so far, see only a modest effect in coming quarters. Based on these factors and ongoing improvement in industry conditions, we continue to expect that our 2004 results will be significantly better than 2003's."

Murdy concluded, "While it's too soon to say our industry is on a sustained upswing, we continue to see positive signs in the marketplace, and are pleased to post results more reflective of the hard work we've been doing inside Comfort Systems USA. We look forward to reporting more improvements as the year unfolds."

The Company will host a conference call to discuss its financial results and position in more depth on Tuesday, May 4, 2004 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-773-756-4621. A replay of the entire call will be available until 6:00 p.m. Central Time, Tuesday, May 11, 2004 by calling 1-402-530-7607.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 63 locations in 51 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, the lack of a combined operating history and the difficulty of integrating formerly separate businesses, retention of key management, national and regional declines in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission.