Comfort Systems USA Reports Third Quarter Results

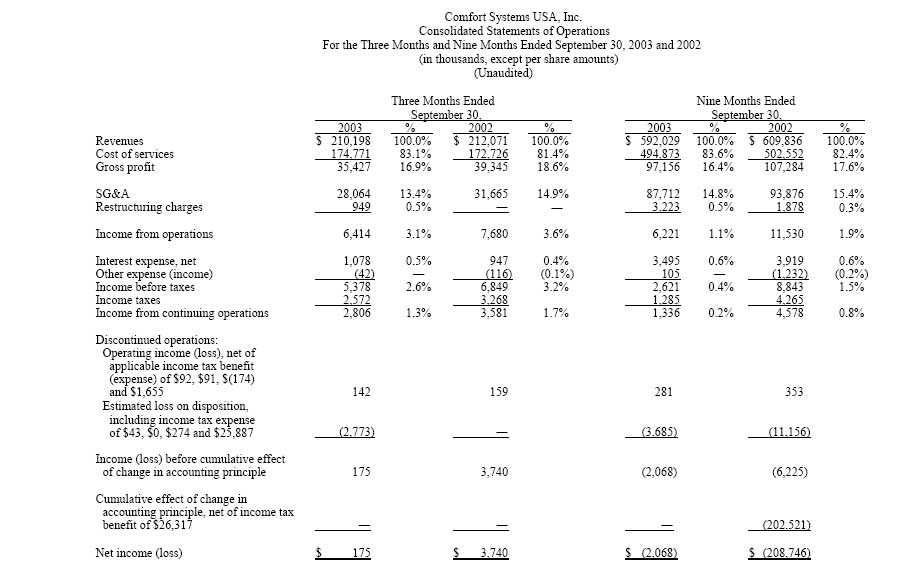

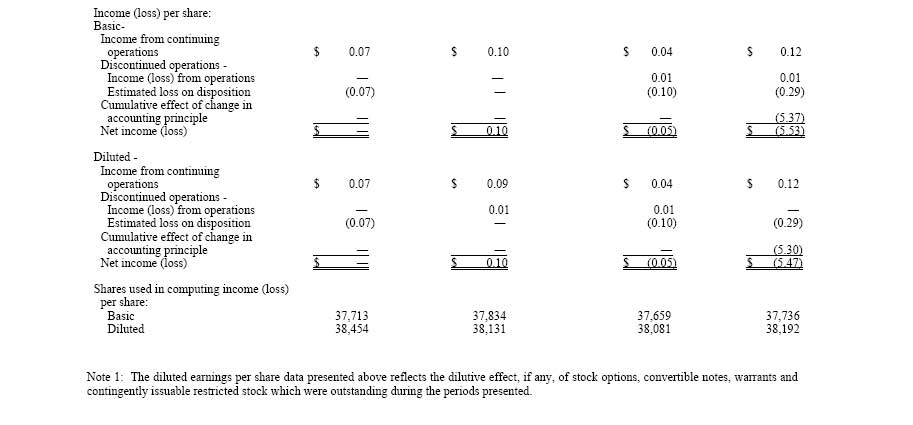

Houston, TX – November 12, 2003 – Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning (“HVAC”) services, today announced net income of $175,000 or $0.00 per diluted share, for the quarter ended September 30, 2003, as compared to net income of $3,740,000 or $0.10 per diluted share, in the third quarter of 2002. Net income from continuing operations for the quarter was $2,806,000 or $0.07 per diluted share in the third quarter of 2003. Excluding the restructuring charges, net income from continuing operations was $3,423,000 or $0.09 per diluted share for the quarter as compared to $3,581,000 or $0.09 per diluted share in the third quarter of 2002. The Company reported revenues from continuing operations of $210,198,000 in the current quarter as compared to $212,071,000 in 2002.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, “Our third quarter reflected another period of steady progress for Comfort Systems USA. While industry activity levels were still restrained, our same-store revenues during the quarter increased 1.3% year-over-year, our best top-line comparison over the past two and a half years of very difficult industry conditions. In addition, excluding a modest restructuring charge, operating margins were up from the second quarter and virtually unchanged from last year's third quarter. This reflects our best year-over-year margin comparison in over a year, as our diligent cost containment kept pace with continuing gross margin pressure.”

The Company reported net income from continuing operations of $1,336,000 or $0.04 per diluted share for the first nine months of 2003 as compared to net income from continuing operations of $4,578,000 or $0.12 per diluted share for the first nine months of 2002. Excluding restructuring charges in both years, and a nonrecurring credit for a favorable receivables settlement in 2002, net income from continuing operations was $3,431,000 or $0.09 per diluted share for the first nine months of 2003 as compared to $5,279,000 or $0.14 per diluted share for the same period in 2002. The Company reported revenues of $592,029,000 from continuing operations for the current year to date, as compared to $609,836,000 in 2002.

Murdy continued, “We continue to see signs of improving conditions in our industry. Recent economic and industry measures have taken positive turns, and commentary from the major industry manufacturers is cautiously optimistic, including continuing recognition of the build-up of deferred maintenance and replacement needs in the installed HVAC base. Based on these trends, our 2004 planning and budgeting work, and our ongoing focus on improving operating execution, we continue to expect that our 2004 results will be significantly better than 2003.”

The Company will host a conference call to discuss its financial results and position in more depth on Wednesday, November 12, 2003 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-630-395-0024. A replay of the entire call will be available until 6:00 p.m. Central Time, Wednesday, November 19, 2003 by calling 1-402-998-1545.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 84 locations in 57 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, the lack of a combined operating history and the difficulty of integrating formerly separate businesses, retention of key management, national and regional declines in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission.