Comfort Systems USA Announces Second Quarter Results

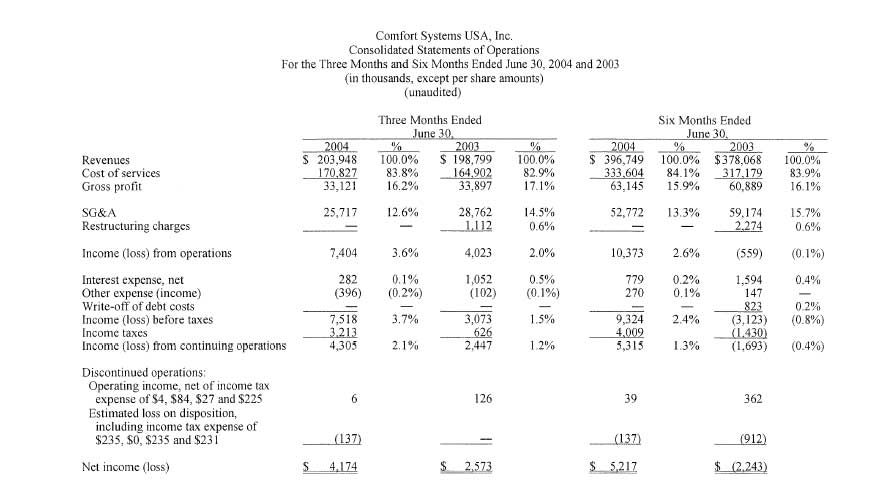

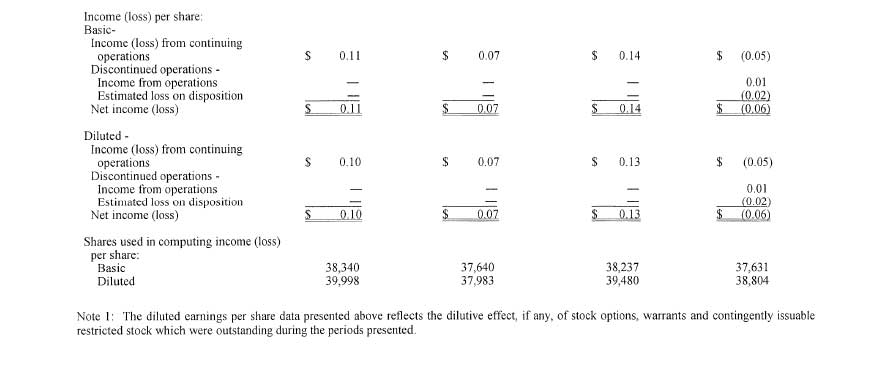

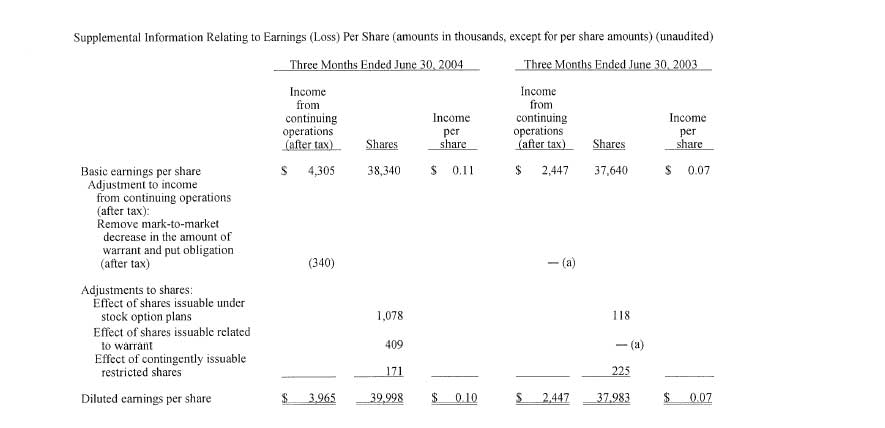

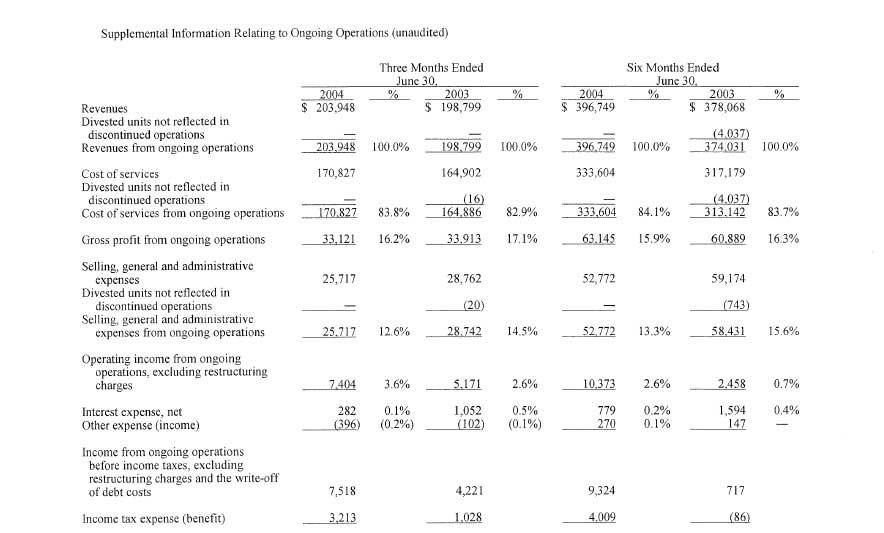

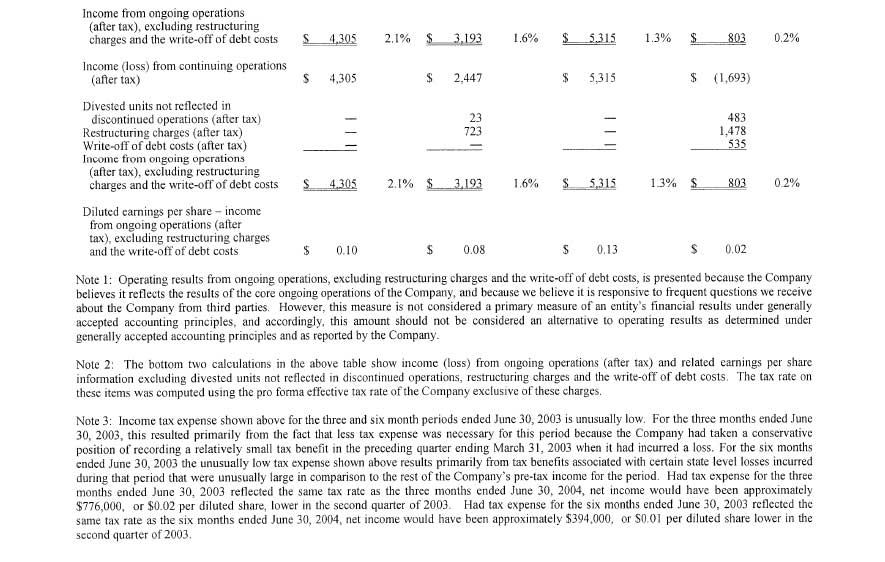

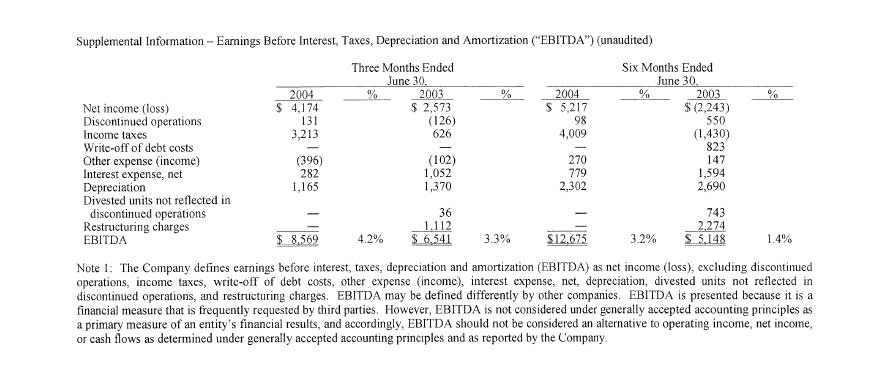

Houston, TX - August 2, 2004 - Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning ("HVAC") services, today announced net income of $4,174,000 or $0.10 per diluted share, for the quarter ended June 30, 2004, as compared to net income of $2,573,000 or $0.07 per diluted share, in the second quarter of 2003. Net income in the second quarter of 2003 was benefited by $0.02 per diluted share resulting from an unusually low tax provision related to a conservative tax position that the Company had taken in the first quarter of last year. Excluding the charges for restructuring and debt cost writeoff, and the effect of divested units not included in discontinued operations, net income from ongoing operations was $3,193,000 or $0.08 per diluted share in the second quarter of 2003, again including a $0.02 per diluted share benefit in connection with the tax item noted previously.

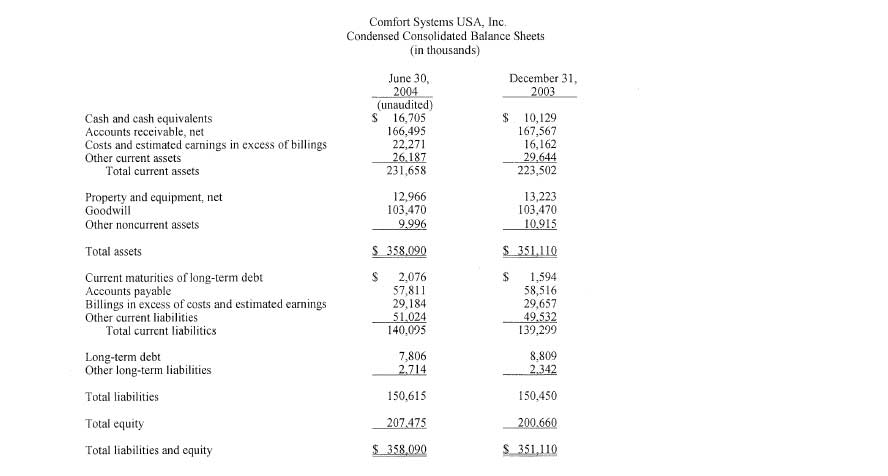

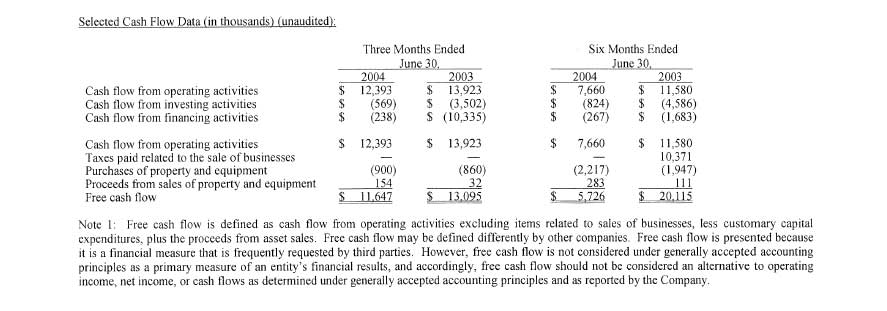

The Company reported revenues from continuing operations of $203,948,000 in the current quarter as compared to $198,799,000 in 2003. The Company also reported free cash flow of $11,647,000 in the current quarter as compared to free cash flow of $13,095,000 in 2003. Backlog as of June 30, 2004 was a record $488,584,000, as compared to $473,163,000, the previous record as of March 31, 2004, and $453,888,000 on a same-store basis as of June 30, 2003.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, "We are pleased to report another quarter of steady progress for Comfort Systems USA. Revenues were up 3% over last year, while operating income at ongoing operations increased 43% and margins climbed by more than 100 basis points. Pre-tax income grew by an even greater amount as a result of significantly lower interest expense this year. Free cash flow came in at healthy levels this quarter, while backlog reached another record growing 8% over last year, and showed indications of improving profitability."

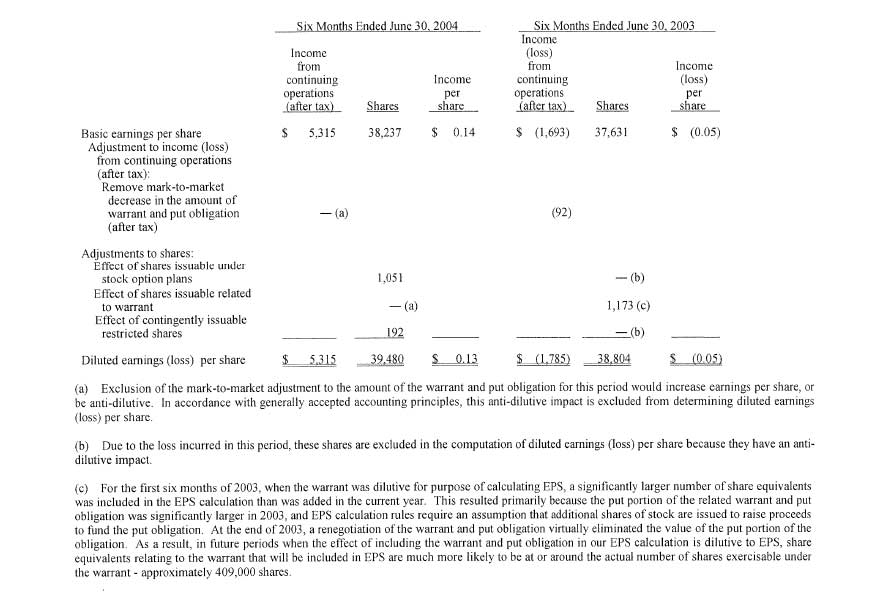

The Company reported net income from continuing operations for the six months ended June 30, 2004 of $5,315,000 or $0.13 per diluted share as compared to a net loss from continuing operations of $1,693,000 or $0.05 per diluted share in 2003. Excluding charges for restructuring, debt cost writeoff, and divested units not reported in discontinued operations, net income from ongoing operations was $803,000 or $0.02 per diluted share for the six months ended June 30, 2003. The latter amount was benefited by $0.01 per diluted share resulting from tax benefits associated with certain state level losses incurred during that period that were unusually large in comparison to the rest of the Company's pre-tax income for the period.

The Company reported revenues of $396,749,000 from continuing operations for the first six months of 2004, as compared to $378,068,000 in 2003. Excluding divested units not reported in discontinued operations, same-store revenues were up 6% from $374,031,000 in 2003.

Murdy continued, "As we noted last quarter, our markets have experienced sharp increases this year in the cost of certain commodities used in our work, including steel, iron, and copper, which comprise 10% to 15% on average of the cost of our projects. We also indicated that we expected commodity inflation to have a modest effect on our results arising from projects where commodity inflation not anticipated in our cost estimates and price commitments could not be recovered in higher revenues on those projects. This effect during the second quarter was approximately $1 million before taxes, or $0.01 per diluted share, which we absorbed while still producing significant income and margin increases for the quarter. Based on certain steps we initiated earlier this year in response to commodity cost volatility, including early buying of materials for certain projects, and price adjustment provisions in project bids and contracts, we expect the impact of unrecoverable commodity cost inflation to be lower in coming quarters than it was in this quarter.

"While it remains possible that broader commodity cost inflation could slow demand for nonresidential new construction and replacement, we have not seen indications of this so far. Instead, we continue to see modestly improving activity levels in our industry. For our part, we have maintained our determined efforts, including cost containment and further strengthening of our balance sheet, to position the Company for ongoing performance as our industry environment turns more favorable. We remain focused on delivering significantly better results for 2004 as compared to 2003."

As previously announced, the Company will host a conference call to discuss its financial results and position in more depth on Tuesday, August 3, 2004 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-773-756-4600. A replay of the entire call will be available until 5:00 p.m. Central Time, Tuesday, August 10, 2004 by calling 1-402-998-1310.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 59 locations in 48 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, the lack of a combined operating history and the difficulty of integrating formerly separate businesses, retention of key management, national and regional weakness in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission.