Comfort Systems USA Reports Fourth Quarter and Full Year Results

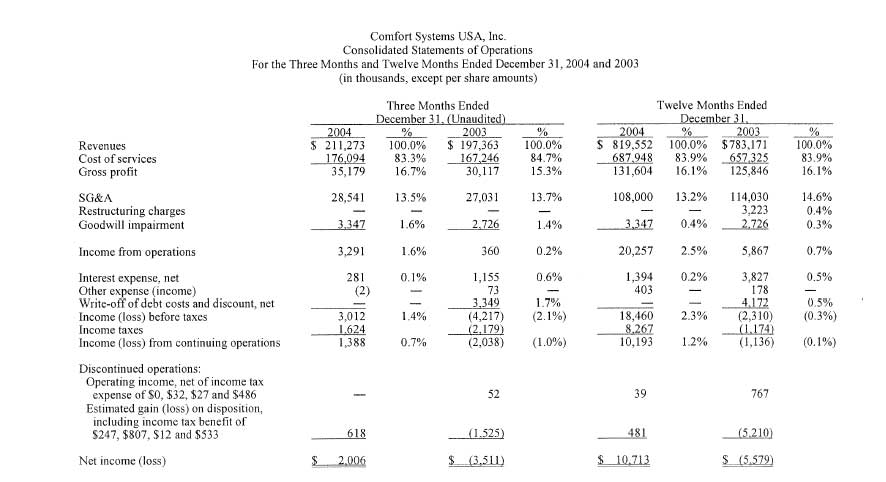

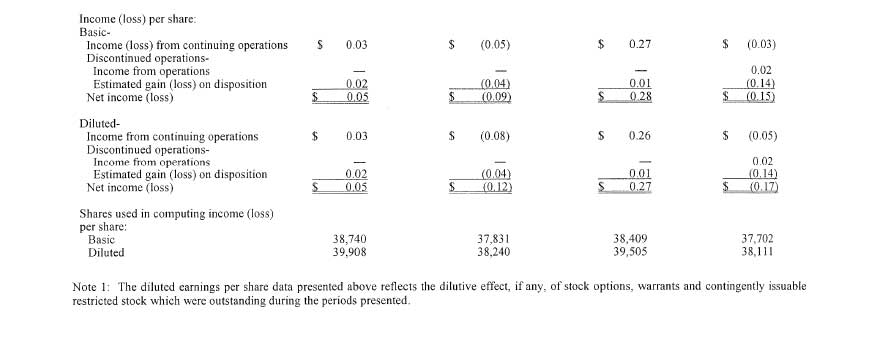

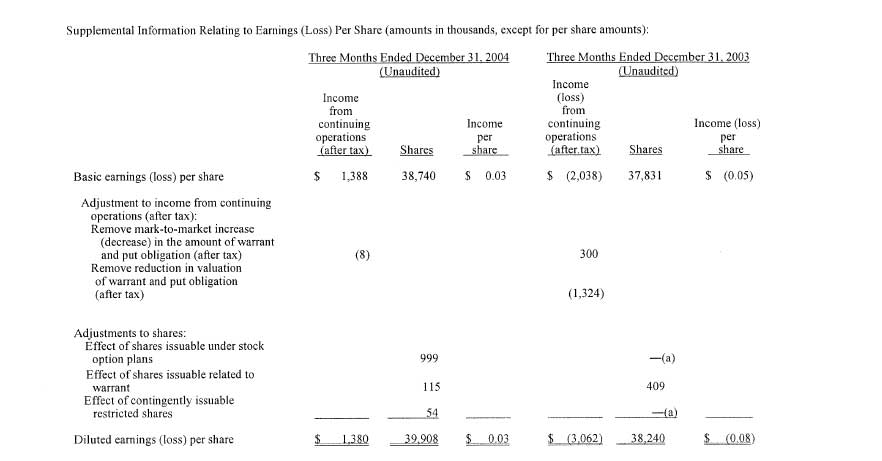

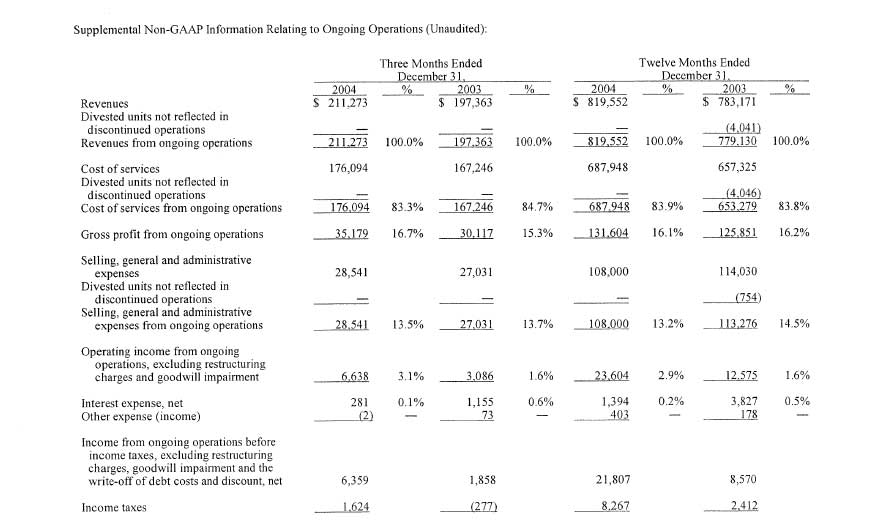

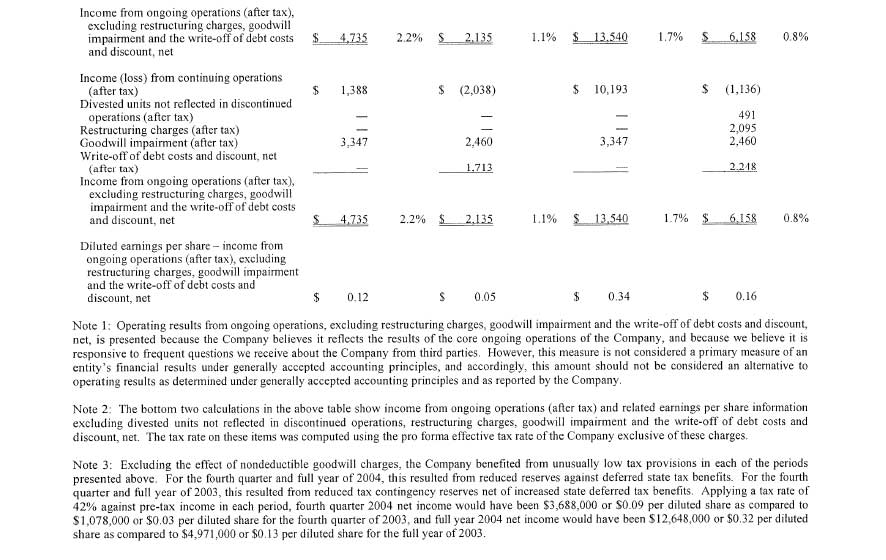

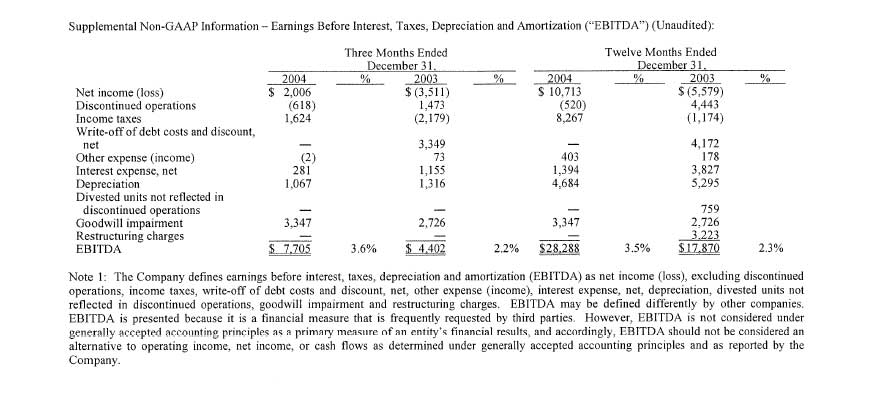

Houston, TX - March 2, 2005 - Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning ("HVAC") services, today announced net income of $2,006,000 or $0.05 per diluted share, for the quarter ended December 31, 2004, as compared to a loss of $3,511,000 or $0.12 per diluted share, in the fourth quarter of 2003. Both current and prior year fourth quarters included income relating to discontinued operations. Excluding these items, income from continuing operations in the fourth quarter of 2004 was $1,388,000 or $0.03 per diluted share as compared to a loss of $2,038,000 or $0.08 per diluted share in 2003.

Both the current and prior year fourth quarters contained charges that are not typically seen in every quarter. Both periods included noncash goodwill impairment charges. In addition, fourth quarter 2003 results also included net noncash charges associated with the termination of the Company's previous credit facility. Excluding these items, net income in the fourth quarter of 2004 was $4,735,000 or $0.12 per diluted share as compared to $2,135,000 or $0.05 per diluted share in 2003. Excluding the effect of nondeductible goodwill charges, both of these periods also benefited from unusually low tax provisions resulting from reduced reserves against deferred state tax benefits in 2004, and reduced tax contingency reserves net of an increase in deferred state tax benefit reserves in 2003. Applying a tax rate of 42% against pre-tax income in both periods, fourth quarter 2004 net income was $3,688,000 or $0.09 per diluted share as compared to $1,078,000 or $0.03 per diluted share for the fourth quarter of 2003.

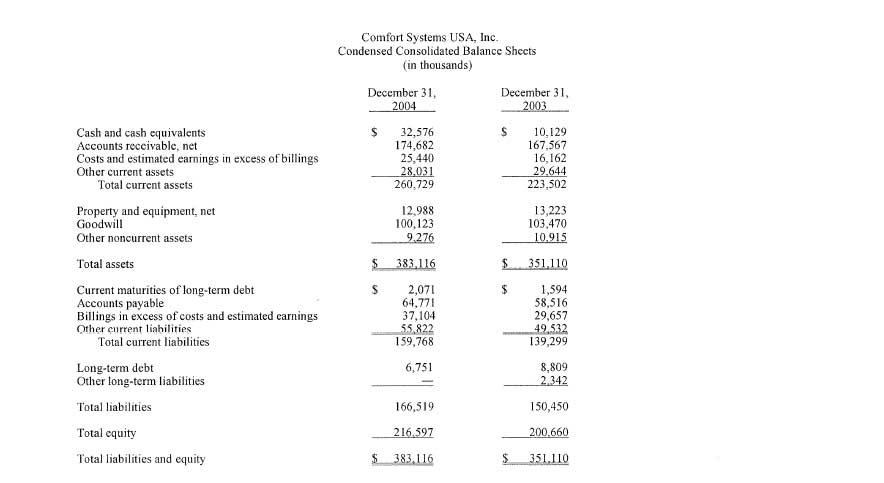

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, "We are pleased to cap a strong 2004 with a solid fourth quarter performance. We continued to capitalize on rebounding activity in our markets, posting our largest backlog increases to date on the way to our fourth consecutive record backlog. Revenue growth and margin improvement, led by our continuing emphasis on safety and risk management, contributed to improved earnings. And we produced a significant amount of free cash flow during the quarter, reflecting a notable increase over last year's fourth quarter and widening our strong net cash position on the balance sheet. We have now generated positive free cash flow in fifteen of our last nineteen quarters."

Murdy continued, "We did record a noncash goodwill impairment charge of $3,347,000 in the fourth quarter, comparable to a similar charge of $2,726,000 in last year's fourth quarter. This charge related to our conclusion that profit levels at three of our smaller operations were likely to remain lower for an extended period of time as compared to the levels these units earned when we acquired them in the late 1990s in stronger overall market conditions. We would note that the new accounting rules relating to goodwill that went into effect in 2002 contemplate periodic impairments of goodwill for business units that have declined in value, while allowing no recognition of increases in business unit values that may have occurred. As a result, we may record additional goodwill impairments in future years, even when the aggregate value of our business units and our company as a whole may be increasing."

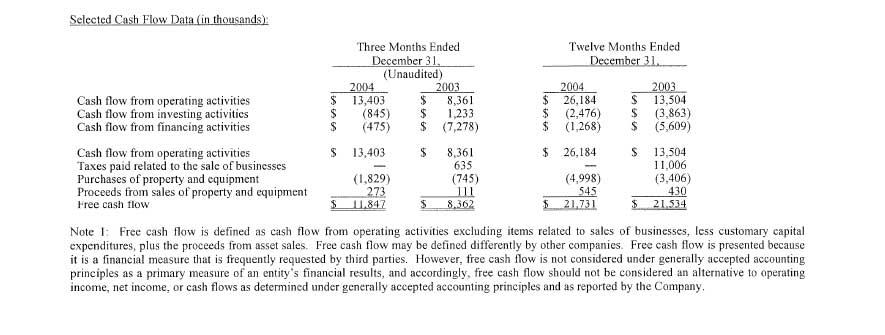

The Company reported revenues from continuing operations of $211,273,000 in the current quarter, an increase of 7.0% as compared to $197,363,000 in 2003. The Company also reported free cash flow of $11,847,000 in the current quarter as compared to $8,362,000 in 2003. Backlog as of December 31, 2004 was a record $573,426,000, up 11.1% from $516,344,000, the previous record as of September 30, 2004, and up 42.0% from $403,896,000 on a same-store basis as of December 31, 2003.

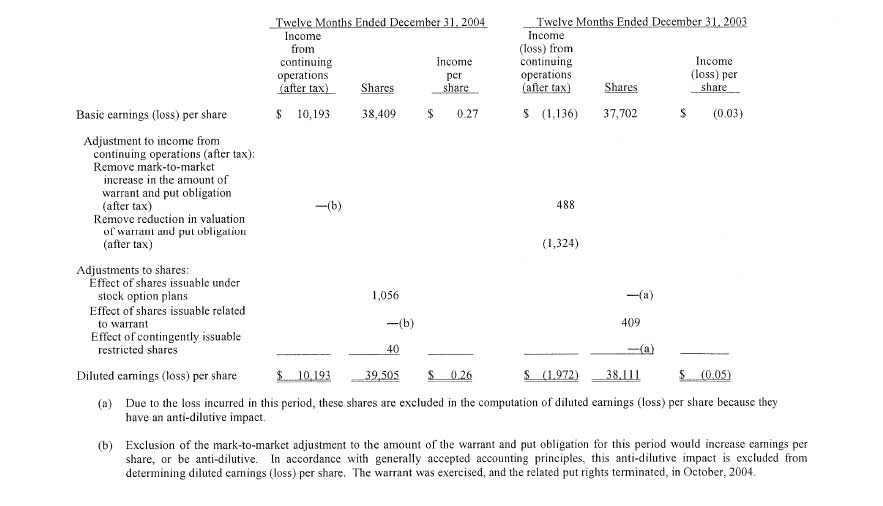

The Company reported net income for the year ended December 31, 2004 of $10,713,000 or $0.27 per diluted share as compared to a loss of $5,579,000 or $0.17 per diluted share in 2003. Excluding discontinued operations, net income from continuing operations was $10,193,000 or $0.26 per diluted share as compared to a loss of $1,136,000 or $0.05 per diluted share. Excluding goodwill impairment charges in both years and excluding charges in 2003 for restructuring, debt cost writeoff, and divested units not reported in discontinued operations, net income from ongoing operations in 2004 was $13,540,000 or $0.34 per diluted share as compared to $6,158,000 or $0.16 per diluted share in 2003. Excluding the effect of nondeductible goodwill charges, both of these periods also benefited from unusually low tax provisions resulting from reduced reserves against deferred state tax benefits in 2004, and reduced tax contingency reserves net of an increase in deferred state tax benefit reserves in 2003. Applying a tax rate of 42% against pre-tax income in both periods, 2004 net income was $12,648,000 or $0.32 per diluted share as compared to $4,971,000 or $0.13 per diluted share for the full year of 2003.

The Company reported revenues of $819,552,000 from continuing operations for 2004 as compared to $783,171,000 in 2003. Excluding divested units not reported in discontinued operations, same-store revenues were up 5.2% from $779,130,000 in 2003. Free cash flow for 2004 was $21,731,000 as compared to $21,534,000 in 2003.

Bill Murdy further noted, "We are also pleased to have reached an important milestone in today's heightened accountability environment for public companies. Consistent with the expectations and requirements of the Sarbanes-Oxley Act of 2002, we conducted an extensive evaluation of the Company's internal controls over financial reporting, which led to management's conclusion, and our auditors' concurrence, that these controls were operating effectively as of December 31, 2004."

Murdy continued, "As we start 2005, we see some indications that our first quarter results will be off compared to last year primarily due to extended inclement weather in Southern California, and uneven customer project schedules at a large operation of ours with a significant backlog. More broadly, though, industry indicators including nonresidential activity and equipment trends reported by HVAC manufacturers continued to strengthen at the end of 2004. These factors together with our strong backlog imply that we will have increased revenues in 2005. In addition, we believe our ongoing productivity and execution efforts will continue to help our margins. For 2005 as a whole, we expect to build on the strong year we just completed in 2004 and again produce better year-over-year results."

As previously announced, the Company will host a conference call to discuss its financial results and position in more depth on Thursday, March 3, 2005 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-212-287-1615. A replay of the entire call will be available until 6:00 p.m. Central Time, Thursday, March 10, 2004 by calling 1-203-369-1780.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 60 locations in 49 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, retention of key management, national and regional weakness in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this release. Comfort Systems USA, Inc. expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in Comfort Systems USA Inc.'s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.