Comfort Systems USA Reports Fourth Quarter and Full Year Results

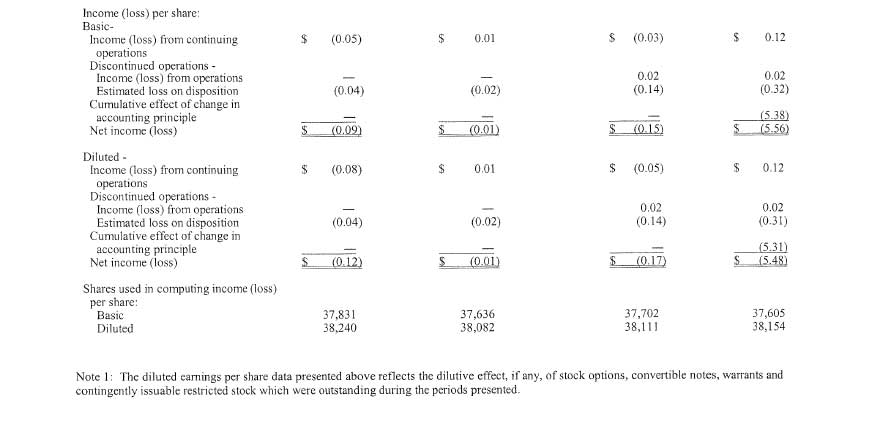

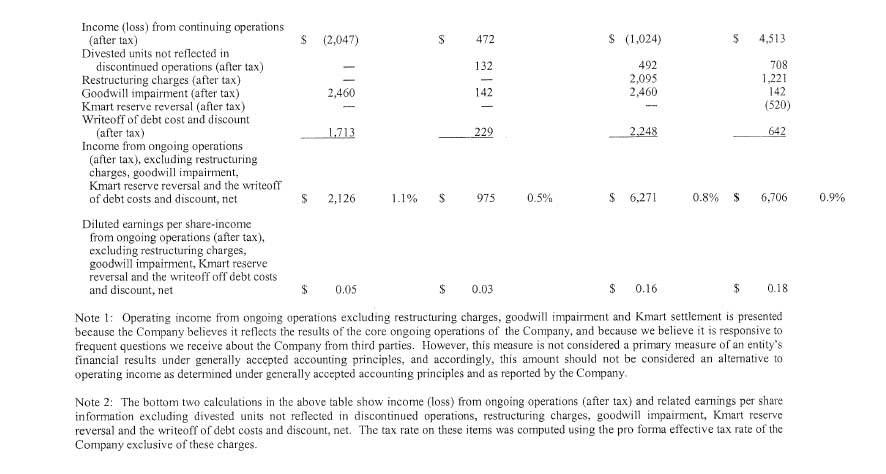

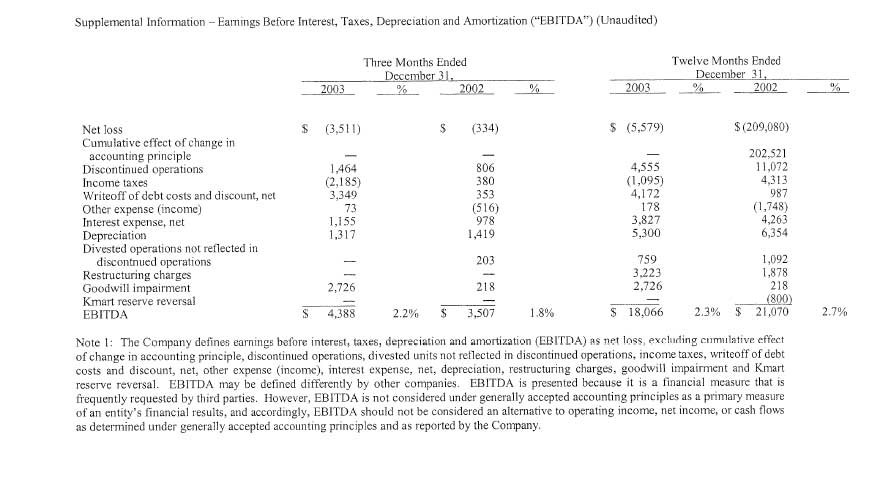

Houston, TX - February 26, 2004 - Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning ("HVAC") services, today announced a net loss of $3,511,000 or $0.12 per diluted share, for the quarter ended December 31, 2003, as compared to a net loss of $334,000 or $0.01 per diluted share, in the fourth quarter of 2002. Net loss from continuing operations for the current quarter was $2,047,000 or $0.08 per diluted share as compared to net income from continuing operations of $472,000 or $0.01 per diluted share, in the prior year. Excluding the noncash charges for goodwill impairment and debt cost writeoff, and the effect of divested units not included in discontinued operations, net income from ongoing operations was $2,126,000 or $0.05 per diluted share for the quarter as compared to $975,000 or $0.03 per diluted share in the fourth quarter of 2002. Operating income from ongoing operations, determined on the same basis, was $3,071,000 or 1.6% of revenues, up 47.1% from $2,088,000, or 1.1% of revenues, in 2002.

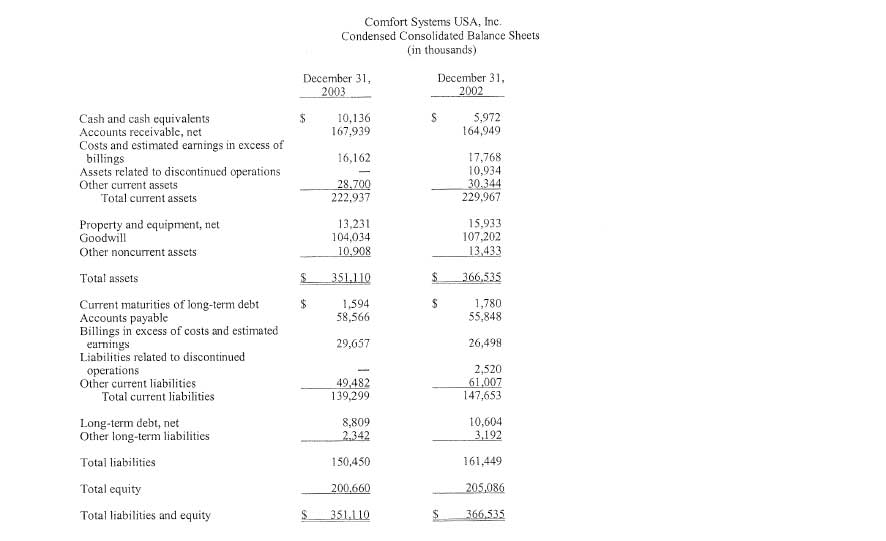

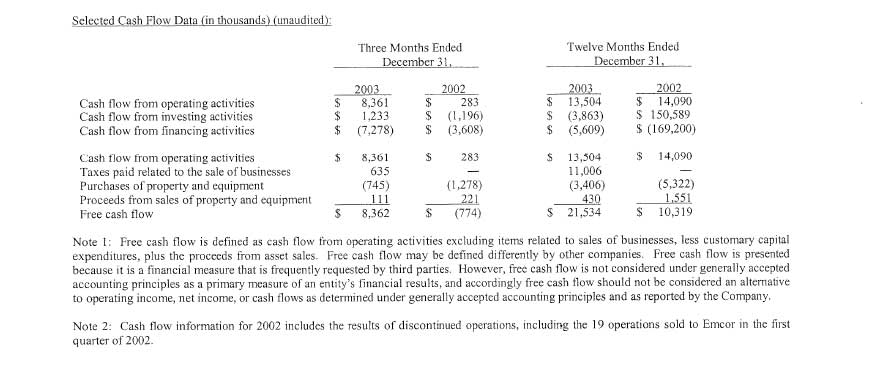

The Company reported revenues from continuing operations of $197,704,000 in the current quarter as compared to $195,824,000 in 2002. Excluding divested units not reported as discontinued operations, same-store revenues increased 4.1% in 2003 from $189,829,000 in 2002. The Company also reported positive free cash flow of $8,362,000 in the current quarter as compared to negative free cash flow of $774,000 in 2002.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, "We were pleased to achieve favorable revenue and income comparisons in our ongoing operations in the fourth quarter, particularly in view of the challenging economic conditions that took hold in our industry a couple of years ago and continued well into 2003. We also posted excellent free cash flow this quarter and finished 2003 with debt, net of cash, at virtually zero. We are encouraged by continuing signs that conditions in our industry will improve in 2004."

The Company reported a net loss from continuing operations for the year ended December 31, 2003 of $1,024,000 or $0.05 per diluted share as compared to net income from continuing operations of $4,513,000 or $0.12 per diluted share in 2002. Excluding charges for restructuring, goodwill impairment, debt cost writeoff, a nonrecurring credit for a favorable receivables settlement in 2002, and divested units not reported in discontinued operations, net income from ongoing operations was $6,271,000 or $0.16 per diluted share for the year ended 2003 as compared to $6,706,000 or $0.18 per diluted share for 2002. Operating income from ongoing operations, determined on the same basis, was $12,766,000 or 1.6% of revenues, as compared to $14,716,000, or 1.9% of revenues in 2002.

The Company reported revenues of $784,976,000 from continuing operations for 2003, as compared to $800,485,000 in 2002. Excluding divested units not reported in discontinued operations, same-store revenues were $780,935,000 in 2003, up 0.8% from $774,537,000 in 2002. The Company also reported free cash flow of $21,534,000 for 2003 as compared to $10,319,000 in 2002.

The Company's fourth quarter results included the following items:

- Noncash writeoff of $3,349,000, pre tax, of deferred debt arrangement costs and discount relating to the termination of the Company's previous credit facility, which was replaced by a new facility with increased capacity and improved terms. This amount was less than previously announced by the Company due to a favorable impact of $1,324,000, pre tax, resulting from the modification of a warrant and put obligation that was issued when the terminated credit facility was originally established. The holder of this warrant and put, one of the Company's lenders in the previous credit facility, agreed to this modification in connection with the termination of the previous credit facility.

- Noncash impairment of goodwill of $2,726,000, pre tax, primarily resulting from changes in operating plans that were identified in the fourth quarter for certain operating units.

- The sale of a small unit, the principal effect of which was the recognition of a noncash loss on disposition of $1,525,000, after tax, under discontinued operations.

Murdy continued, "The past several years have been a time of unprecedented challenge in the commercial, industrial, and institutional building sector, where we provide HVAC services. Throughout this time, our core operations have remained profitable and cash flow positive each year, and today our Company is effectively debt-free after having reached borrowing levels of almost $350 million in 2000. We were also pleased to complete certain steps as part of 2003's business, including the establishment of an improved credit facility, which necessitated the noncash writeoff in the fourth quarter of costs associated with our previous credit facility, the sale of selected smaller units not fully aligned with our ongoing strategy, and various restructuring actions initiated earlier in the year.

"These steps have given us a good start for 2004, a year in which our primary emphasis will be on internal execution and margin improvement. Based on this focus as well as our expectation that industry and economic conditions will improve in 2004, we believe that our 2004 results will be significantly better than our 2003 results. We look forward to renewed success at Comfort Systems USA."

As previously announced, the Company will host a conference call to discuss its financial results and position in more depth on Friday, February 27, 2004 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-773-756-4600. A replay of the entire call will be available until 6:00 p.m. Central Time, Friday, March 5, 2004 by calling 1-402-998-1433.

Comfort Systems USA is a premier provider of business solutions addressing workplace comfort, with 63 locations in 51 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, the lack of a combined operating history and the difficulty of integrating formerly separate businesses, retention of key management, national and regional weakness in non-residential construction activity, difficulty in obtaining or increased costs associated with debt financing or bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract and other risks detailed in the Company's reports filed with the Securities and Exchange Commission.