Comfort Systems USA Reports Second Quarter Results

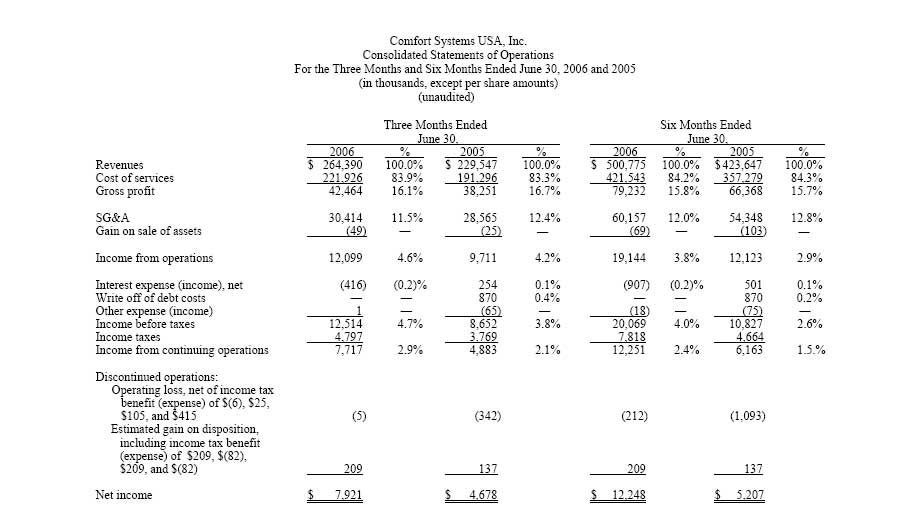

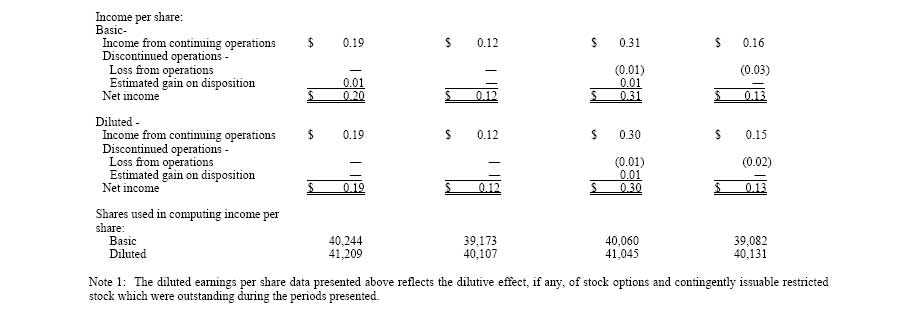

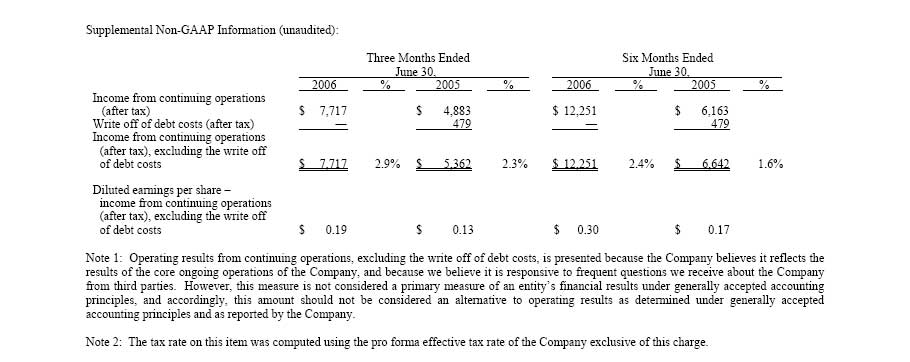

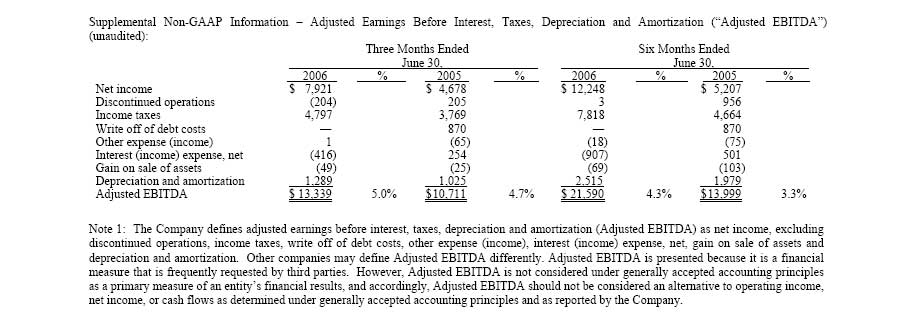

Houston, TX – August 2, 2006 – Comfort Systems USA, Inc. (NYSE: FIX), a leading provider of commercial, industrial and institutional heating, ventilation and air conditioning (“HVAC”) services, today announced net income of $7,921,000 or $0.19 per diluted share, for the quarter ended June 30, 2006, as compared to net income of $4,678,000 or $0.12 per diluted share, in the second quarter of 2005. Excluding the write off of debt costs, net income from continuing operations was $5,362,000 or $0.13 per diluted share for the quarter ended June 30, 2005.

Bill Murdy, Comfort Systems USA's Chairman and CEO, said, “We are pleased with our strong second quarter results and with the strength and improvement our operations continue to demonstrate. Significant increases in profits and revenues in our second quarter build solidly on our strong first quarter, and they add to our optimism about the future.”

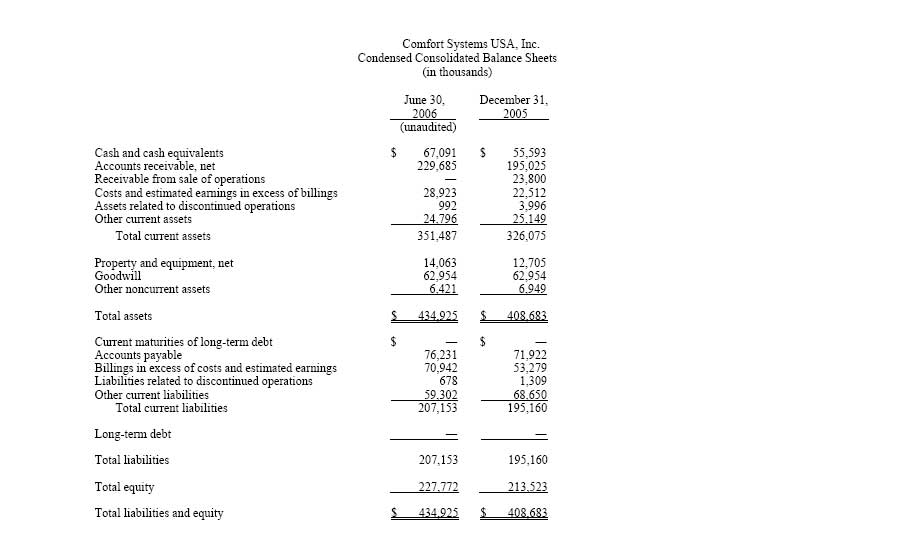

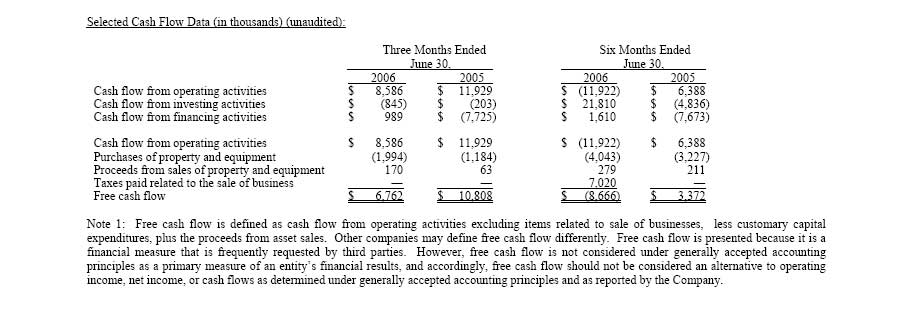

The Company reported revenues from continuing operations of $264,390,000 in the current quarter, an increase of 15.2% as compared to $229,547,000 in 2005. The Company also reported free cash flow of $6,762,000 in the current quarter as compared to free cash flow of $10,808,000 in 2005. Backlog as of June 30, 2006 was $689,993,000, as compared to $726,726,000, as of March 31, 2006 on a same store basis. Backlog as of June 30, 2005 was $618,717,000 on a same store basis.

The Company reported net income for the six months ended June 30, 2006 of $12,248,000 or $0.30 per diluted share as compared to net income of $5,207,000 or $0.13 per diluted share in 2005. The Company reported net income from continuing operations for the six months ended June 30, 2006 of $12,251,000 or $0.30 per diluted share as compared to net income from continuing operations of $6,163,000 or $0.15 per diluted share. Excluding the write off of debt costs, net income from continuing operations was $6,642,000 or $0.17 per diluted share for the six months ended June 30, 2005. The Company reported revenues of $500,775,000 from continuing operations for the first six months of 2006, as compared to $423,647,000 in 2005.

Murdy continued, “Net income essentially doubled for the first half of 2006 as compared to the first half of 2005. Our recent very high backlog levels continued, although we experienced a decrease in backlog levels in our multi-family residential activities this quarter that resulted in a sequential decrease in total backlog, while total backlog was up significantly from the same quarter a year ago. The decrease in multifamily residential backlog more than accounted for the drop in total backlog, and thus backlog levels for commercial work actually increased during the second quarter.”

Bill Murdy concluded, “In recent years Comfort Systems USA has successfully executed a strategy of developing our team members and strengthening our core operations. Although we continue our focus on improving existing operations, we are also concentrating on making prudent investments in growth. With a strong balance sheet and continued strength in our core operations, we look forward to a busy and successful third quarter and year.”

As previously announced, the Company will host a conference call to discuss its financial results and position in more depth on Thursday, August 3, 2006 at 10:00 a.m. Central Time. The call-in number for this conference call is 1-210-234-0008. A replay of the entire call will be available until 6:00 p.m. Central Time, Thursday, August 10, 2006 by calling 1-402-220-0275.

Comfort Systems USA® is a premier provider of business solutions addressing workplace comfort, with 57 locations in 51 cities around the nation. For more information, visit the Company's website at www.comfortsystemsusa.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current plans and expectations of Comfort Systems USA, Inc. and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, among others, retention of key management, national or regional weakness in non-residential construction activity, difficulty in obtaining or increased costs associated with bonding, shortages of labor and specialty building materials, seasonal fluctuations in the demand for HVAC systems and the use of incorrect estimates for bidding a fixed price contract, the Company's backlog failing to translate into actual revenue or profits, errors in the Company's percentage of completion method of accounting, the result of competition in the Company's markets, the imposition of past and future liability from environmental, safety, and health regulations including the inherent risk associated with self-insurance, adverse litigation results and other risks detailed in the Company's reports filed with the Securities and Exchange Commission. Important factors that could cause actual results to differ are discussed under “Item 1A. Company Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2005. These forward-looking statements speak only as of the date of this release. Comfort Systems USA, Inc. expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in Comfort Systems USA, Inc.'s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.